Why Are Fewer Companies Going Public in Europe?

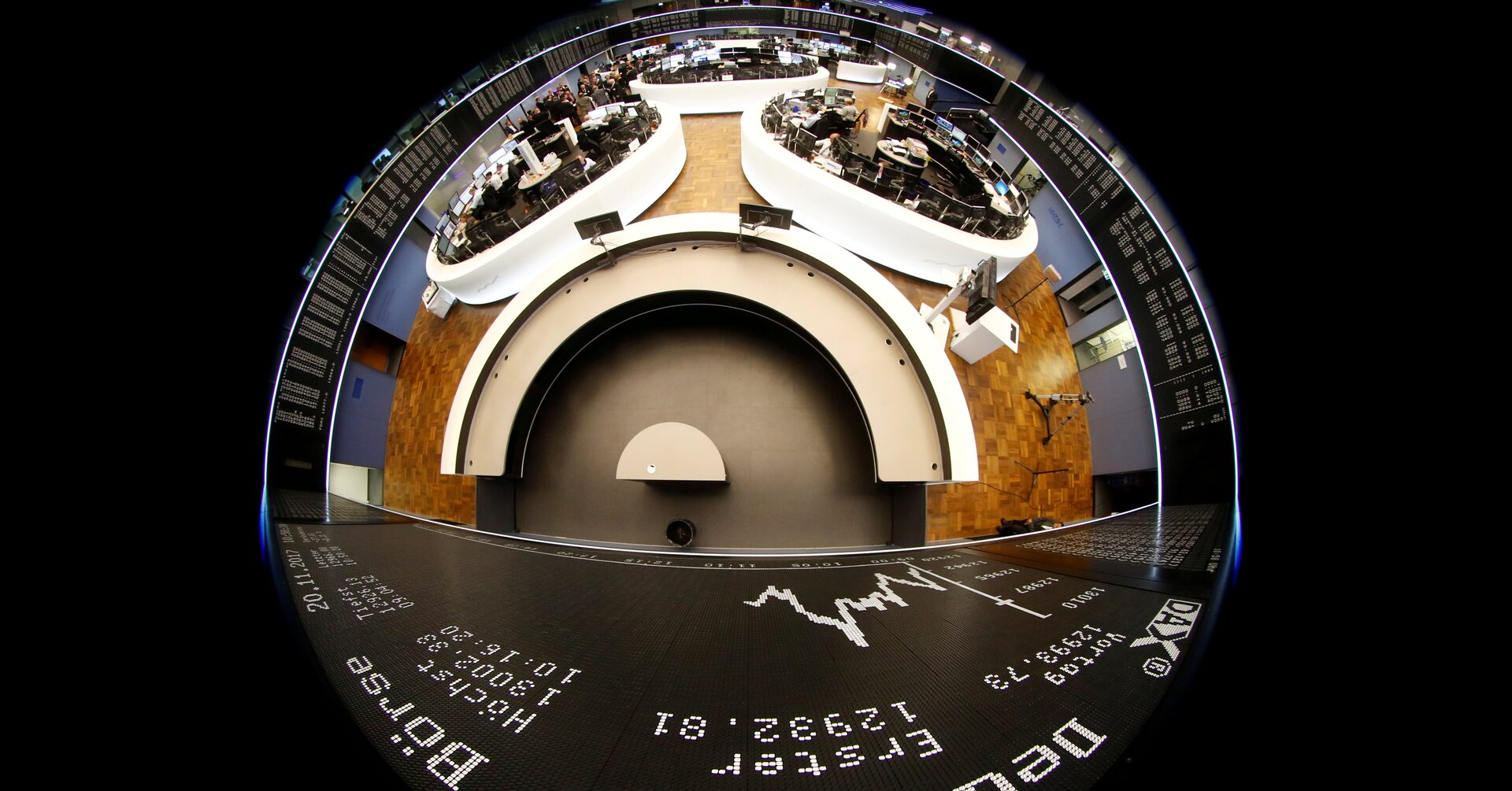

If you’ve been following financial headlines lately, you may have noticed a troubling trend: Europe’s share listings plumb 10-year low as companies seek alternatives. Once a cornerstone of economic growth and investor opportunity, public listings across European exchanges—from London to Frankfurt—are drying up.

This isn’t just a blip—it’s a structural shift with real consequences for investors, startups, and the broader economy. In this article, we’ll unpack why this is happening, explore where companies are turning instead, and what it means for the future of European finance.

What’s Behind Europe’s Decline in Public Listings?

According to data from Euronext and Refinitiv, the number of initial public offerings (IPOs) on major European exchanges fell to its lowest level since 2013 in 2024. Only 58 IPOs were recorded across the EU and UK—a stark drop from over 150 in 2021.

Several interconnected factors explain this slump:

- Market Volatility: Geopolitical tensions, inflation spikes, and interest rate hikes have made public markets riskier.

- Regulatory Burden: Europe’s MiFID II and GDPR compliance add significant costs and complexity for small-to-mid-sized firms.

- Valuation Gaps: Many tech and growth-stage companies feel undervalued by public investors compared to private valuations.

- Rise of Private Capital: Venture capital, private equity, and SPACs offer faster, more flexible funding without public scrutiny.

As London Stock Exchange CEO Julia Hoggett noted in a 2025 interview: “Companies today have more options than ever. Going public used to be the pinnacle—but now it’s just one path among many.”

Where Are Companies Turning Instead of IPOs?

With traditional IPOs losing appeal, European firms are increasingly exploring alternative routes to raise capital and scale. Here’s a breakdown of the top alternatives gaining traction:

| Alternative | Key Features | Best For |

|---|---|---|

| Private Equity (PE) | Long-term capital, strategic guidance, no quarterly reporting | Mature companies seeking scale |

| Venture Debt | Non-dilutive loans paired with equity warrants | Startups with recurring revenue |

| Direct Listings | Bypass underwriters; existing shares trade publicly | Well-known brands (e.g., Spotify model) |

| SPACs (Special Purpose Acquisition Companies) | Faster route to public markets via merger | High-growth firms needing speed |

Notably, private equity dry powder (uninvested capital) in Europe hit €350 billion in 2024, according to Preqin—giving firms ample room to absorb promising companies that once would’ve gone public.

For deeper context on how stock exchanges function within this ecosystem, see Wikipedia’s overview of stock exchanges.

How Does Europe Compare to the U.S. and Asia?

The contrast is striking. While Europe’s IPO activity stagnates, the U.S. saw over 200 IPOs in 2024, driven by AI startups, biotech firms, and resilient tech giants. Nasdaq and NYSE continue to dominate global listings.

Meanwhile, Asia—particularly India and Southeast Asia—is experiencing an IPO boom. India alone recorded 92 IPOs in 2024, fueled by digital transformation and retail investor enthusiasm.

Why the gap? Experts point to three key differences:

- Investor Culture: U.S. markets reward innovation and long-term vision; European investors often prioritize short-term profitability.

- Capital Availability: U.S. venture ecosystems (Silicon Valley, Boston) offer deeper, earlier-stage funding.

- Regulatory Agility: The SEC has adapted faster to new models (e.g., Reg A+), while EU regulation remains fragmented across 27 member states.

“Europe lacks a unified capital market,” says Dr. Lena Müller, economist at the Centre for European Policy Studies. “Until we fix that, companies will keep looking elsewhere.”

What Are the Economic Consequences of Fewer Listings?

Fewer public companies might seem like a niche issue—but it has ripple effects:

- Reduced Retail Investment Opportunities: Ordinary Europeans miss out on early-stage growth (e.g., owning shares in the next SAP or Spotify).

- Weaker Market Liquidity: Thinly traded exchanges struggle to attract institutional investors.

- Innovation Drain: Top startups may relocate headquarters to the U.S. or list on Nasdaq, taking jobs and tax revenue with them.

- Pension Fund Challenges: Many EU pension funds rely on public equities for stable returns—fewer quality listings limit diversification.

A 2025 study by the European Securities and Markets Authority (ESMA) warned that if current trends continue, Europe could lose 30% of its listed companies by 2030.

Can Europe Reverse This Trend? Proposed Solutions

Policymakers aren’t standing still. Several initiatives aim to revive Europe’s listing culture:

- Capital Markets Union (CMU) Acceleration: The EU plans to harmonize listing rules across member states by 2027.

- SME Growth Markets: New “light-touch” segments on Euronext and Deutsche Börse reduce compliance for smaller firms.

- Tax Incentives: Countries like France and the Netherlands now offer capital gains exemptions for long-term shareholders in newly listed firms.

- Tech IPO Task Forces: The UK launched a dedicated unit to fast-track high-potential tech IPOs post-Brexit.

Still, success hinges on execution. As one Berlin-based founder told us: “I’d love to list in Frankfurt—but only if I don’t need a team of lawyers just to file quarterly reports.”

FAQ: Your Questions About Europe’s Listing Crisis

Q1: What does “Europe’s share listings plumb 10-year low” actually mean?

It means the number of companies listing shares on European stock exchanges has dropped to its lowest point in a decade—fewer IPOs, fewer new tickers, and shrinking market depth.

Q2: Are any sectors still going public in Europe?

Yes—renewables, defense, and healthcare saw modest IPO activity in 2024. However, tech and consumer startups overwhelmingly prefer private routes.

Q3: Is this trend bad for everyday investors?

Potentially, yes. Public markets democratize wealth creation. When companies stay private longer, average investors can’t participate in early growth phases.

Q4: Could direct listings become popular in Europe?

Possibly—but they require strong brand recognition and liquidity. So far, only giants like Ferrari have tested this model successfully in Europe.

Q5: How does Brexit factor into this decline?

Brexit added friction (e.g., loss of passporting rights), but the trend predates 2016. Deeper issues like fragmentation and risk aversion are bigger drivers.

Q6: What should a founder do if they’re considering going public?

First, compare total cost of listing (legal, compliance, underwriting) vs. private alternatives. Second, assess investor appetite in your sector. Third, consider dual-listing (e.g., Euronext + Nasdaq) for broader reach.

Final Thoughts: A Crossroads for European Finance

Europe’s share listings plumb 10-year low as companies seek alternatives—but this moment isn’t just a crisis; it’s a catalyst for reform. The decline reveals deep structural gaps, yet also opens the door to smarter, more agile capital markets.

For investors: Stay informed about private market opportunities (via platforms like Seedrs or Crowdcube).

For founders: Don’t default to “IPO = success.” Choose the path that aligns with your vision.

For policymakers: Now is the time to build a truly unified, innovation-friendly listing environment.

If you found this analysis helpful, share it on LinkedIn or X (Twitter) to spark conversation about Europe’s financial future. The next decade of European growth depends on the choices we make today.

Leave a Reply