Are you involved in construction, facility management, or real estate development in the U.S. or Canada? If so, you’ve likely encountered the growing demand for integrated Mechanical, Electrical, and Plumbing (MEP) services. The North America Mechanical Electrical and Plumbing Services Market is undergoing rapid transformation—driven by smart buildings, sustainability mandates, and labor shortages. In this guide, we’ll break down what’s fueling this growth, who the key players are, and how you can stay ahead in this competitive landscape.

What Is Driving Growth in the North America MEP Services Market?

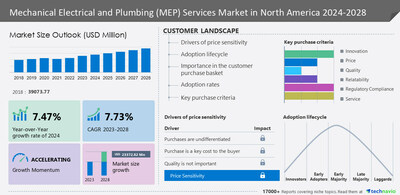

The North America MEP services market isn’t just expanding—it’s evolving. According to a 2024 report by Grand View Research, the market was valued at USD 138.7 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030. But what’s behind this momentum?

- Green Building Regulations: Cities like New York, Los Angeles, and Toronto enforce strict energy codes (e.g., NYC Local Law 97), pushing developers to adopt high-efficiency MEP systems.

- Labor Shortages: The U.S. construction sector faces a shortage of over 500,000 skilled tradespeople, increasing reliance on specialized MEP contractors.

- Smart Technology Integration: IoT-enabled HVAC, lighting, and plumbing systems now account for over 30% of new commercial MEP installations.

- Infrastructure Investment: The U.S. Infrastructure Investment and Jobs Act (2021) allocated $1.2 trillion, with significant portions flowing into building modernization—directly benefiting MEP firms.

“MEP is no longer just about pipes and wires—it’s the nervous system of modern buildings,” says Elena Rodriguez, Senior MEP Consultant at Jacobs Engineering.

Who Are the Top Players in the North America MEP Market?

Competition is fierce, but a few firms dominate through scale, innovation, and strategic partnerships:

| AECOM | Los Angeles, CA | Full-spectrum engineering; strong federal contracts |

| Jacobs Engineering | Dallas, TX | Focus on sustainable, tech-integrated MEP design |

| EMCOR Group | Norwalk, CT | Largest U.S. mechanical and electrical contractor by revenue |

| Hill International | Philadelphia, PA | MEP project management for complex builds |

Smaller regional firms are also thriving by specializing in niches like hospital MEP retrofits or data center cooling systems.

For more on the engineering services sector, see Wikipedia’s overview of MEP engineering .

How Are MEP Services Evolving with Technology?

Gone are the days of manual blueprints and reactive maintenance. Today’s MEP services leverage cutting-edge tools:

- BIM (Building Information Modeling): Over 75% of large MEP firms now use BIM for clash detection and 3D coordination, reducing rework by up to 40%.

- Prefabrication: Modular MEP racks are assembled off-site, cutting installation time by 30–50%—critical in tight urban schedules.

- AI-Powered Energy Analytics: Systems like Siemens Desigo or Johnson Controls Metasys optimize HVAC and lighting in real time, slashing energy use by 15–25%.

- AR for Field Technicians: Apps like Microsoft HoloLens overlay digital MEP schematics onto physical spaces, improving accuracy and safety.

Pro Tip: When hiring an MEP contractor, ask if they use BIM Level 2 compliance—it’s now a baseline expectation for commercial projects.

Regional Breakdown: U.S. vs. Canada MEP Markets

While often grouped, the U.S. and Canadian MEP landscapes differ in regulation, demand, and innovation pace.

| Market Size (2023) | ~$125B | ~$13.7B |

| Key Drivers | Infrastructure Act, data centers, healthcare expansion | Green building codes (e.g., Toronto Green Standard), transit projects |

| Labor Challenges | Severe skilled labor shortage | Moderate, but improving via immigration pathways |

| Tech Adoption | High (especially in CA, TX, NY) | Growing, led by Vancouver and Toronto |

Both countries are seeing strong growth in retrofit projects, as aging buildings (especially schools and hospitals built in the 1970s–90s) require MEP system upgrades to meet current codes.

Challenges Facing MEP Contractors Today

Despite growth, the industry faces real hurdles:

- Supply Chain Volatility: Copper, PVC, and electrical components still face 8–12 week lead times in some regions.

- Margin Pressure: Intense competition keeps profit margins tight—average net margins hover around 3–5%.

- Regulatory Complexity: Navigating local codes (e.g., California Title 24 vs. Ontario Building Code) requires deep compliance expertise.

- Cybersecurity Risks: As MEP systems go digital, they become targets—62% of facility managers report increased concern over building automation hacks (2024 IFMA Survey).

Future Outlook: What’s Next for the MEP Market?

By 2030, the North America Mechanical Electrical and Plumbing Services Market will be shaped by three mega-trends:

- Decarbonization: Net-zero building mandates will drive demand for heat pumps, solar-ready electrical systems, and water-recycling plumbing.

- Workforce Innovation: Expect more use of robotic pipe welders and AI scheduling tools to offset labor gaps.

- Resilience Design: Post-pandemic and climate-aware clients want MEP systems that withstand extreme heat, floods, and grid outages.

Firms that invest in sustainability certifications (LEED, WELL) and digital twin capabilities will win premium contracts.

FAQ Section

Q1: What does MEP stand for in construction?

A: MEP stands for Mechanical, Electrical, and Plumbing—the three core engineering disciplines that ensure buildings are functional, safe, and comfortable. Mechanical covers HVAC, electrical includes power and lighting, and plumbing handles water supply and drainage.

Q2: How big is the North America MEP services market?

A: As of 2023, it’s valued at $138.7 billion, with the U.S. accounting for roughly 90% of that total. Growth is strongest in healthcare, data centers, and mixed-use developments.

Q3: Are MEP services required for all buildings?

A: Yes. Every commercial, industrial, and multi-family residential building must have integrated MEP systems to meet local building codes, fire safety standards, and occupancy permits.

Q4: What’s the difference between MEP design and MEP installation?

A: MEP design involves engineering plans (often by consultants), while MEP installation is the physical construction work done by licensed contractors. Many firms now offer both (“design-build”).

Q5: How can I choose a reliable MEP contractor?

A: Look for:

- Valid state/provincial licenses

- BIM and prefabrication experience

- References from similar project types

- Safety record (check OSHA or WSIB history)

Q6: Will AI replace MEP engineers?

A: Not replace—but augment. AI handles repetitive tasks (load calculations, code checks), freeing engineers to focus on system optimization, sustainability, and client strategy.

Conclusion

The North America Mechanical Electrical and Plumbing Services Market is at a pivotal moment—balancing innovation with infrastructure demands, sustainability with cost control, and tradition with digital transformation. Whether you’re a developer, facility manager, or investor, understanding these dynamics gives you a competitive edge.

If you found this guide helpful, share it with your network on LinkedIn or Twitter—helping others stay informed in this fast-changing industry. And don’t forget to bookmark this page for future reference as market trends evolve!

Stay smart. Build better. Think MEP.

Leave a Reply