If you’ve recently hired a plumber in Colorado—or are planning to—you might be wondering: Are you charged sales tax for plumbing repair in Colorado? It’s a common question, especially since tax rules for services can be confusing and vary widely by state. You don’t want any surprises on your invoice, and you certainly don’t want to overpay due to a misunderstanding. The good news? Colorado’s tax rules for plumbing services are clearer than you think. Let’s break it down in plain English.

Is Plumbing Labor Taxed in Colorado?

Short answer: No—plumbing labor is generally not subject to sales tax in Colorado.

Colorado treats most repair and maintenance services—including plumbing—as non-taxable when it comes to labor. This means if a plumber charges you $150 for unclogging a drain or fixing a leaky faucet, that labor fee is not subject to state sales tax.

However—and this is a crucial “however”—any tangible goods or parts the plumber installs are taxable. So if your repair includes a new faucet, water heater element, or pipe fitting, those items will be taxed at the applicable local sales tax rate.

💡 Example: A $200 plumbing job includes $150 in labor and $50 in parts. You’ll pay sales tax only on the $50—not the full $200.

This distinction aligns with Colorado’s broader tax philosophy: services are typically exempt, but physical products are taxable—even when installed as part of a service.

How Does Colorado Define “Taxable” vs. “Non-Taxable” Plumbing Work?

Not all plumbing-related work is treated the same. Colorado’s Department of Revenue (CDOR) draws important lines between:

| Type of Work | Taxable? | Why? |

|---|---|---|

| Repair & Maintenance (e.g., fixing leaks, unclogging drains) | ❌ No (labor only) | Considered a non-taxable service |

| Installation of New Fixtures (e.g., new sink, toilet, water heater) | ✅ Yes (on parts only) | Tangible personal property is taxable |

| New Construction Plumbing | ❌ No | Entirely exempt under CO law for residential builds |

| Emergency Service Calls | ❌ No (labor) | Still classified as repair/maintenance |

According to the Colorado Department of Revenue’s publication DR 0095, “Charges for labor to repair, maintain, or install tangible personal property are not subject to sales tax unless the labor is part of a taxable sale of the property.”

In simpler terms: If you’re buying a product and getting it installed, the product is taxed—but the installation labor isn’t.

What Sales Tax Rate Applies to Plumbing Parts in Colorado?

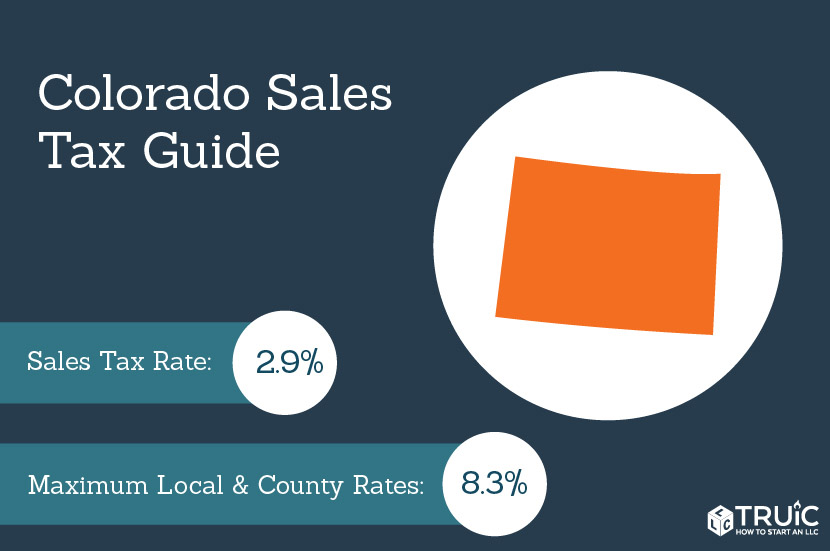

Colorado doesn’t have a single statewide sales tax rate. Instead, it uses a combined rate made up of:

- State base rate: 2.9%

- County and city rates: Vary widely (0% to over 8%)

So your total sales tax on plumbing parts could range from 2.9% to 11%+, depending on your location.

📍 Real-world example:

- In Denver: ~8.81% combined rate

- In Colorado Springs: ~8.35%

- In rural Weld County: as low as 3.5%

Always check your local rate using the Colorado Sales Tax Rate Lookup Tool before budgeting for repairs.

Common Misconceptions About Plumbing Tax in Colorado

Let’s clear up some myths:

- “All home services are tax-free.”

→ False. While most labor isn’t taxed, certain services (like carpet cleaning or landscaping in some cases) can be taxable. Plumbing repair, however, is consistently non-taxable for labor. - “If it’s on one invoice, the whole thing is taxed.”

→ Not true. Reputable plumbers separate labor and parts on invoices. If they don’t, ask for an itemized breakdown—this protects you from overpayment. - “New water heaters are always taxed.”

→ Mostly true—but if you’re installing a water heater as part of new home construction, it may be exempt under contractor rules (see below).

Special Case: New Construction vs. Remodeling

Colorado makes a key distinction between new residential construction and remodeling/repair:

- New construction: Plumbing materials installed by a licensed contractor are not subject to sales tax at the point of sale. Instead, the contractor pays a “use tax” on materials (not passed to you).

- Remodeling or repair: You do pay sales tax on parts purchased or installed.

This stems from Colorado’s contractor tax rules, where contractors in new builds act as consumers of materials, not resellers.

🔍 For more on service taxation frameworks across U.S. states, see the Wikipedia entry on sales taxes in the United States.

How to Avoid Overpaying Sales Tax on Plumbing Services

Follow these 4 steps to ensure you’re taxed correctly:

- Ask for an itemized invoice

Ensure labor and parts are listed separately. - Verify your local tax rate

Use the CDOR lookup tool to confirm the correct rate. - Question bundled charges

If a plumber says “everything is taxed,” push back politely—Colorado law doesn’t support that for standard repairs. - Keep records for 3+ years

In case of an audit or billing dispute, documentation protects you.

FAQ Section

Q1: Do plumbers in Colorado have to collect sales tax?

A: Yes—but only on tangible goods they sell and install (like pipes, faucets, or water heaters). Labor for repair or maintenance is not taxable.

Q2: What if my plumber charged tax on the whole bill?

A: This may be an error. Request a corrected, itemized invoice. If they refuse, you can report potential overcharging to the Colorado Department of Revenue.

Q3: Are water heater replacements taxed?

A: If it’s a repair or replacement in an existing home, yes—the unit itself is taxed. But labor to install it is not. In new construction, the tax treatment differs.

Q4: Is drain cleaning taxable in Colorado?

A: No. Drain cleaning is considered a maintenance service, so only the service fee (labor) applies—no sales tax.

Q5: What about commercial plumbing repairs?

A: The same rules apply: labor is non-taxable, but parts are taxable—whether residential or commercial.

Q6: Can I get a refund if I was overcharged sales tax?

A: Yes. Contact the business first. If unresolved, file a claim with the Colorado Department of Revenue.

Conclusion

So, are you charged sales tax for plumbing repair in Colorado? For labor—no. For parts—yes. Understanding this distinction can save you money and prevent billing surprises.

Colorado’s approach reflects a growing trend: taxing goods, not services. As a homeowner, staying informed ensures you’re treated fairly and comply with state tax expectations.

If this guide helped clarify your plumbing tax questions, share it with friends or neighbors in Colorado—they’ll thank you the next time they call a plumber! 💧🔧

Got more questions? Drop them in the comments or consult a local tax professional for complex scenarios.

Leave a Reply